In 2020, over 100,000 restaurants shut their doors for the last time (NRA).

The COVID-19 pandemic brought traditional foodservice to its knees. Stay-at-home orders, fluctuating food prices, and labor shortages pushed food operators to their limits. As supply chains, international trade, and demand for dining in restabilize, we reflect on how the COVID-19 pandemic changed the foodservice industry forever. Here are 5 hallmarks of the “new normal” for foodservice

1. Digitization

Having an online presence became vital during the pandemic. Without foot traffic and traditional dine-in experiences, operators needed a way to reach new and existing customers.

Giving customers an option to order online was the first priority. Operators who did not have an online ordering system were certainly pushed in that direction. Many turned to online POS systems like Toast and Lightspeed to seamlessly take orders online without the need to answer the phone. The last thing they wanted was to have to answer the phone and take an indecisive order while juggling line cooks, inspectors, and raw meat. Consumers enjoyed the freedom to view pictures, view prices, and make orders from their couch without hopping on the phone with a waiter-turned-call-center-worker who was trying to rush their order. Mass adoption of online ordering brought convenience to both food creators and consumers, and it’s here to stay.

Next up, marketing communications. Operators needed a way to announce new dishes, special hours, and promotions to consumers who weren’t leaving home. Non-digitized brands who wanted to thrive needed to jump into the world of digital marketing. Web design, SEO, and social media became the focus of foodservice operators at a time when their brand vibe couldn’t be felt in person.

Those who went all in on digitization enjoy omnichannel reach today.

The weapon of choice is a bit different depending on the type of operator. As it stands, table service restaurants tend to find professional websites more effective, while fast casuals find the most success with social media (QSR).

The dawn of foodservice digitization came long before the pandemic, but COVID-19 brought it to full light. Now that consumers are used to getting a feel of a restaurant by scrolling on their smartphones, operators need to do the same to create content, curate 5-star reviews, and manage the platforms that their customers have come to rely on so heavily.

2. Technology

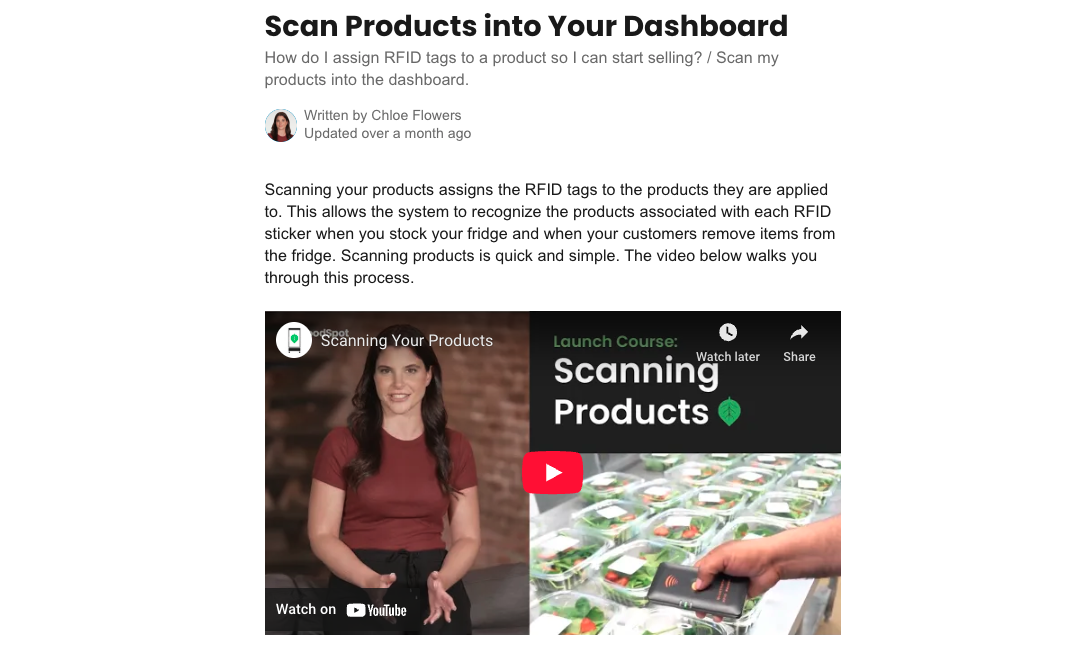

With labor and human contact at record lows, the foodservice industry was hungry for disrupting innovations. In fast food chains, ordering kiosks became more of a rule than an exception, and touchless soda dispensers were introduced at burger joints. These expensive adoptions weren’t installed just to be uninstalled a few months later. If anything, they will only get better as time goes on.

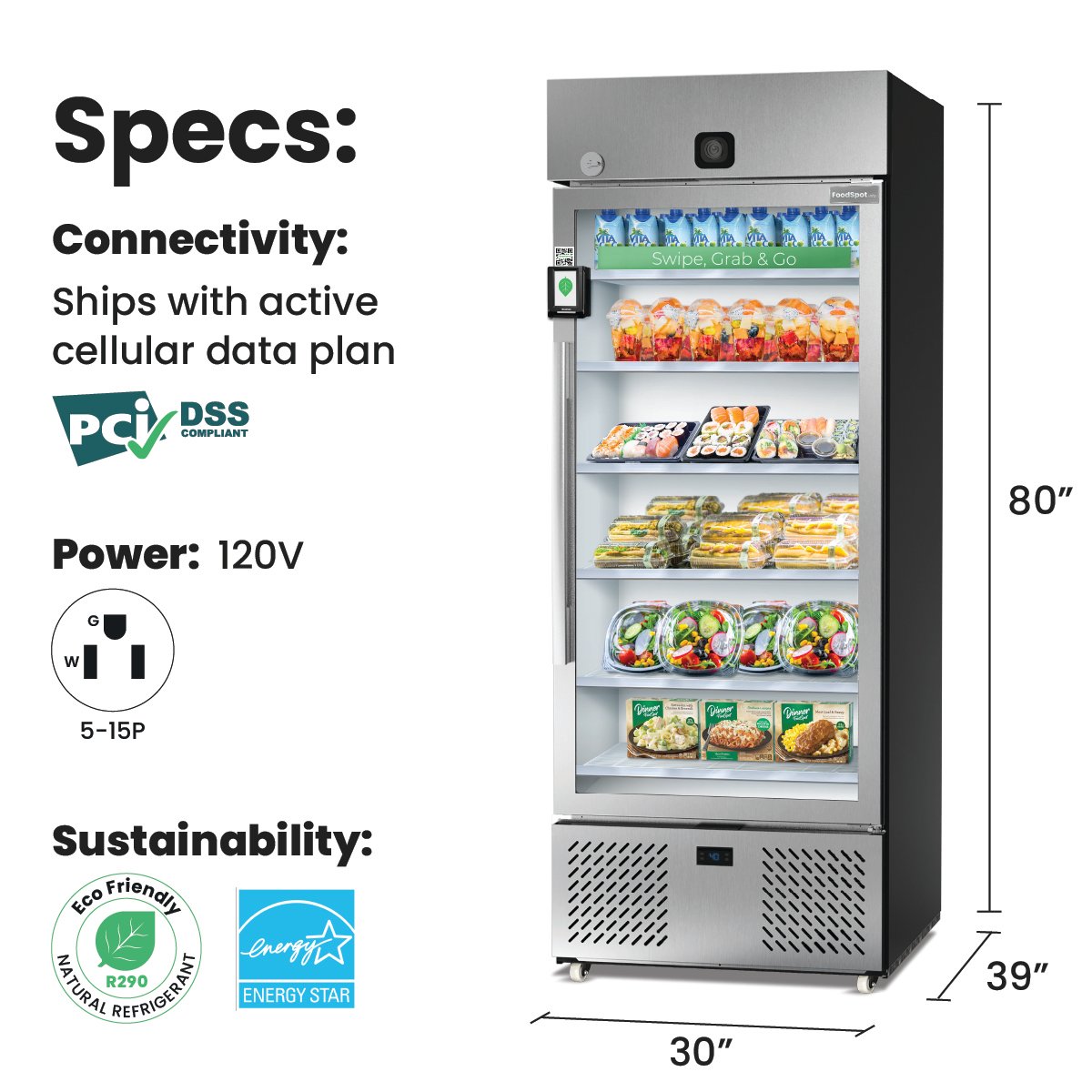

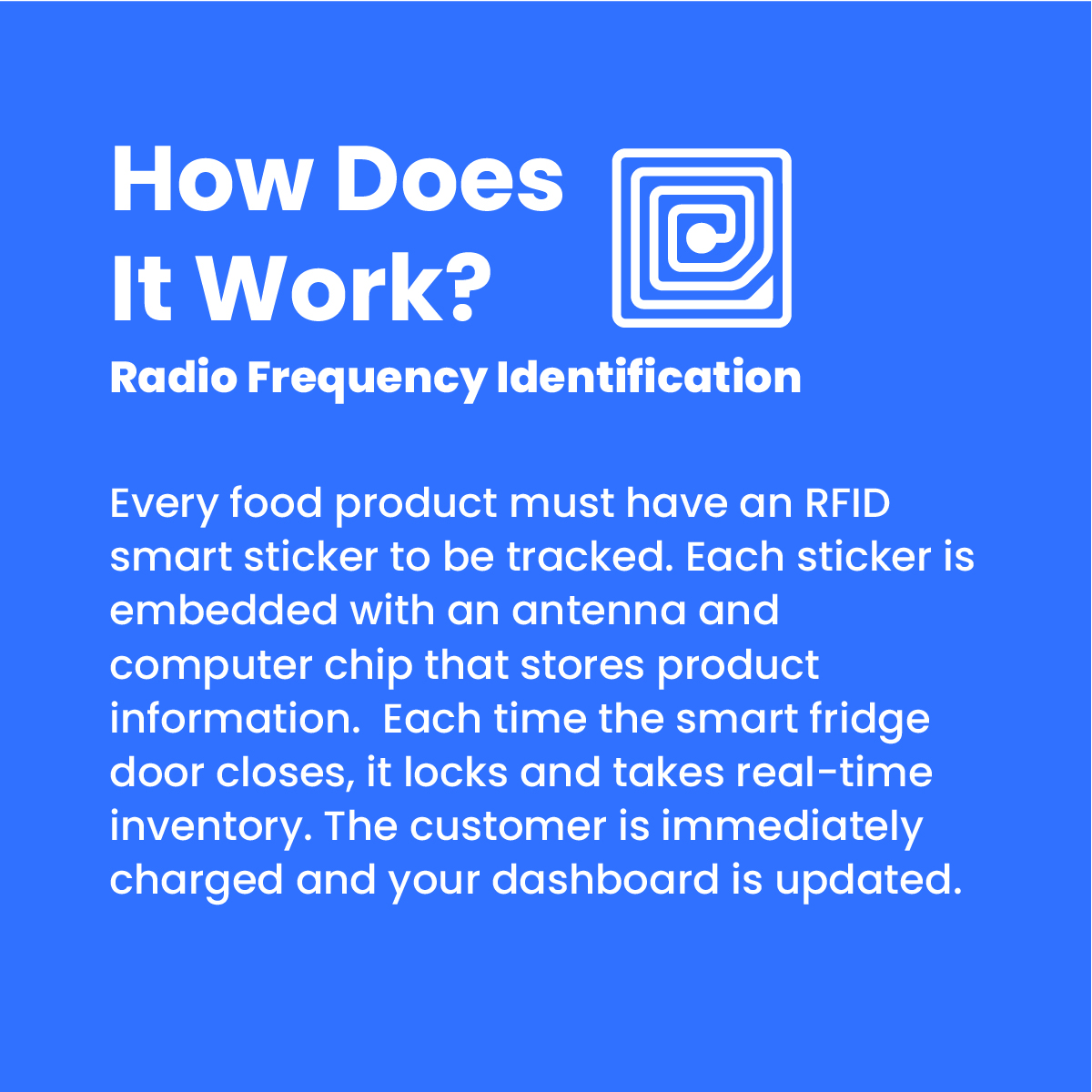

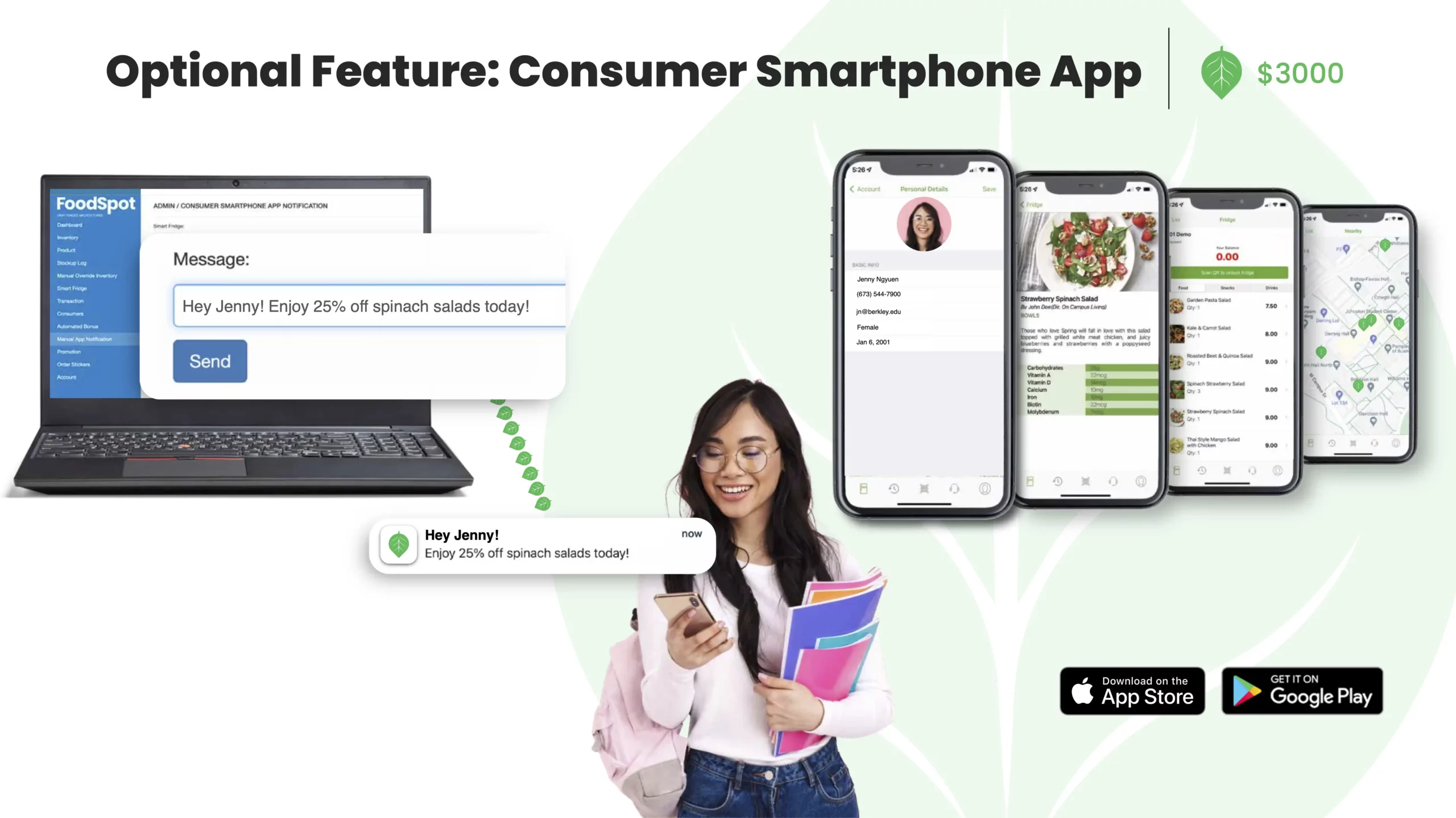

Innovations outside the brick-and-mortar also took the stage. Salad robots, pizza machines, and smart fridges allowed food operators to open in busy locations and sell 24/7. These solutions do not require onsite labor and give operators a new revenue stream they could enjoy without the sacrifice of opening another brick-and-mortar location. Today, in a new normal, these foodtech solutions are no longer a part of Plan B. Rather, these technologies empower creators to meet customers on their terms and grow same-store sales while honoring their own lifestyles.

3. Delivery

Delivery and takeout are manifestations of what is called off-premises dining, or eating in a location other than where the food was purchased. Dining at home became the norm during the pandemic: drive-thru sales increased by 47%, and delivery rose by 85% for quick-service restaurants (franchise.com). To meet this new demand, operators shifted resources to hiring delivery drivers, expanded to multi-lane drive-thrus, and moved staff outside to take orders from cars by tablet.

Dining off-premises doesn’t seem to be going away.

In an article titled, “Surprise ingredients in a post-pandemic food story,” Deloitte reported that one-third of consumers said they’d be dining out less than before.

The company conducted a net activity change analysis to benchmark post-pandemic activity against pre-pandemic activity. Ordering food for takeout and delivery is expected to expand by 20% for good while eating at a restaurant shows a 12% decrease. However, delivery presents its own problems. Other than its environmental impacts, food safety is also a concern as outlined by Erica Lee, Director of LaunchSuccess at FoodSpot, in her recent article, “Food Delivery Safety – How Safe is Your Meal?”

Looking forward, more food entrepreneurs will skip dine-in altogether and go straight for delivery and takeout. Many old and new establishments will execute this model through ghost kitchens.

4. Ghost Kitchens

To meet the demand for off-premises dining, many operators have utilized ghost kitchens to start or stay in business. The lower rent and fully-equipped kitchens allow operators to meet the consumer demand for convenience without paying for unnecessary labor, dining space, or build-out.

Ghost kitchens have taken many headlines throughout the pandemic, and the way these headlines are written give utterance to their permanence. For example, Restaurant Dive published an article titled, “How the pandemic accelerated the US ghost kitchen market ‘5 years in 3 months,” which projects the ghost kitchen market to be valued at 1 trillion dollars by 2030.

Who’s driving this growth? Old and new dogs alike. Bentobox published an article called “4 Reasons Ghosts Kitchens Will Succeed in the New Normal.” Bentobox gives examples of both new brands and older brands that have entered the ghost kitchen space. The article cited a tweet by the YouTuber Mr. Beast, announcing he had “just launched 300 restaurants nationwide” with the help of ghost kitchens. The article wasn’t shy about mentioning “older dogs” getting into the ghost kitchen space as well:

“Helping the cause is a recent series of investments from large restaurant brands. Wendy’s, for example, plans to open 700 new ghost kitchens by 2025, while Chipotle, Five Guys and even retailers like Walmart and Kroger have entered the space in ways that make sense for their businesses.”

5. Labor Shortage

Millions of foodservice jobs were lost during the first few weeks of shutdown (NRA). By the numbers, this looks less like a hiatus and more like an exodus.

From October 2021 to March 2022, the number of foodservice job openings exceeded the number of hires by 500,000 per month. This gap is the opposite of the trend for the past 20 years, with the pandemic being the inflection point (see below).

Coming out of the pandemic, returning workers demand higher wages, better benefits, and better hours, but many are not returning at all. This past April, the number of jobs in eating and drinking places was still 6.4% of their pre-pandemic levels. The NRA says “no other industry has a longer road to reach a full employment recovery.” FoodSpot CEO, Nathan Downs goes as far as to say that “pandemic-related shifts in business models will yield some permanence to being less reliant on labor-intensive operations.” How is the industry responding?

Foodservice will not go away, so operators need creative ways to do what they love with limited labor. Technologies like smart vending allow operators to sell fresh food around the clock in more places without the need for extra onsite labor. You can read about the different smart vending technologies in our blog post, “Comparing Smart Vending Machine Technologies.”

Looking On: Food Security and Rising to the Challenge

According to the USDA, 1 out of 10 Americans experienced food insecurity in 2020.

The pandemic ravaged individuals’ and families’ ability to access sufficient nutrition. While the economy stabilizes, the jarring experience of many Americans remains top of mind. How will the foodservice industry respond?

Digitization, delivery, foodtech, ghost itchens, and Labor Shortages push food creators to adopt innovations that empower them to sell more for less. In an industry with notoriously low margins, this could be revolutionary in solving fresh food accessibility throughout the U.S. In order for fresh food to be truly accessible, it needs to be democratized for both creator and consumer. Creators need low cost, low risk, and low stress ways to offer fresh food. Consumers need a path to fresh food with low friction, low time commitment, and low prices.

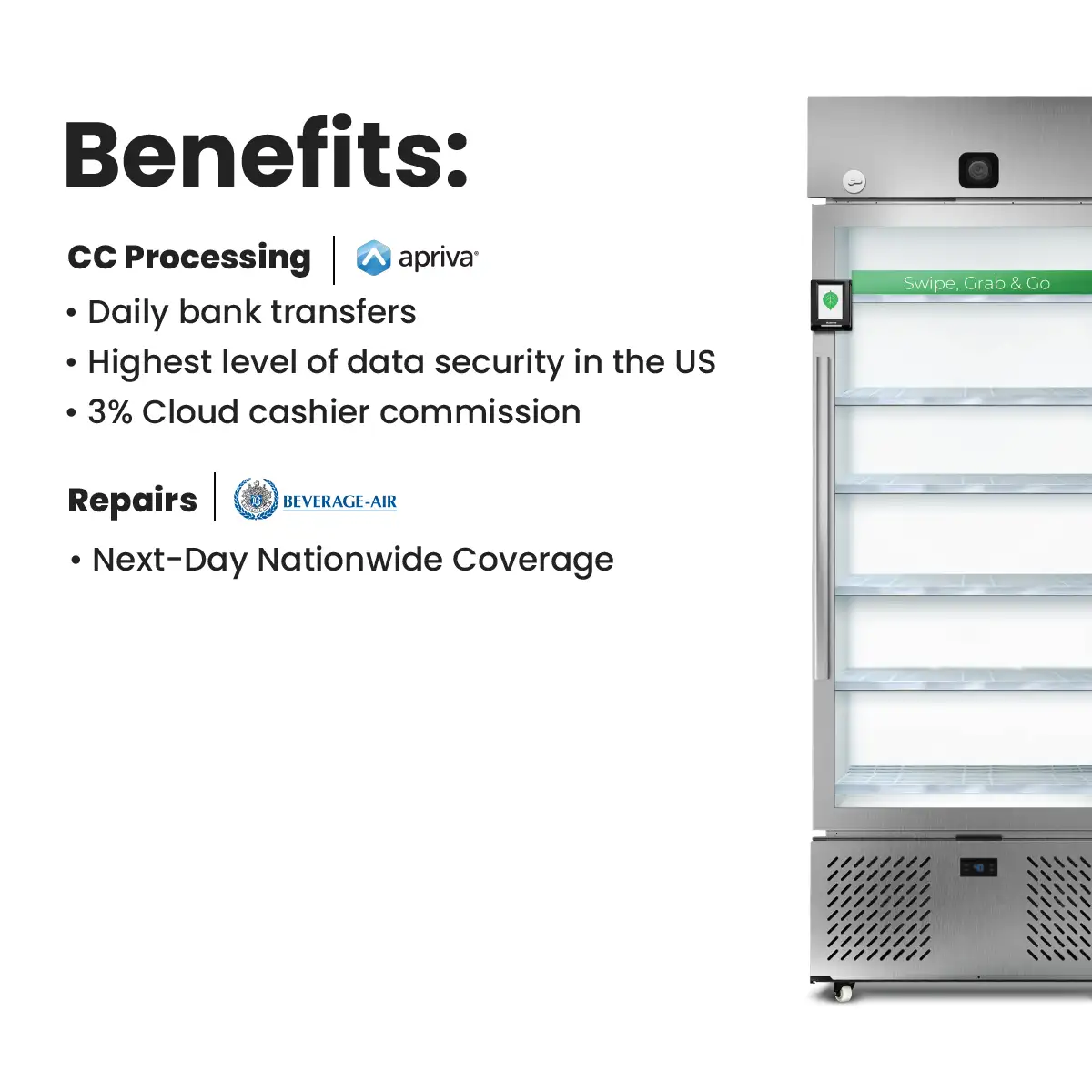

As an industry-leading smart vending platform, FoodSpot lives and breathes our mission to democratize fresh food. We believe our unattended microstores are paving the way towards fresh food accessibility for all. Contact us at sales@launchfoodspot.com to learn more.